Your self-assessment checklist 2022/23

4th May 2023

We’re already almost a month into the new tax year and yet it probably doesn’t feel like two minutes since you were paying your last tax bill. Now’s the time to get started on gathering your information together so we can submit your new tax return on time. You’ve probably already had a letter from […]

What’s the most tax-efficient director’s salary in 2023/24?

4th April 2023

The most tax-efficient limited company director’s salary for 2023/24 As we head into a new tax year we’ve been doing our homework in the background as usual to come up with the best strategy for directors’ salaries. We work on the basis of making the most of your tax allowance and taking account of things […]

What’s the optimum limited company director’s salary for 2022/23?

9th September 2022

We get asked quite a lot of questions about the optimum limited company director’s salary and why we recommend the amount we do. Here we explain the multiple factors at play when we arrive at a figure. What do we take into account when calculating the recommended salary? It’s a complex calculation to figure out […]

TLC Loves… Electric company cars

29th June 2022

By now we’re all aware of the many benefits electric cars can have over traditional fuel-filled ones but making the switch to electric can still feel like taking a plunge into the unknown. As a small business owner who relies on your car, you may have questions like: ‘Will it get me from a-b without […]

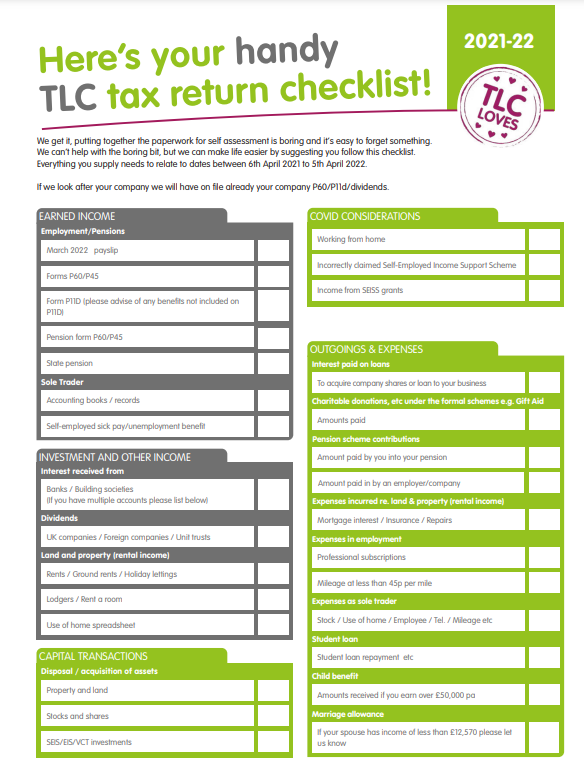

Your handy self-assessment checklist 2021-22

4th May 2022

As usual, we’ve created a handy self-assessment checklist to help you prepare everything for your self-assessment tax return. Remember this year we won’t be doing your tax return if your details are with us any later than 15 November, so make sure you get everything together in good time. Click here to download the TLC […]

TLC for all – what’s on the menu this month!

25th November 2021

You’ll know by now that here at TLC, we totally love calculators and we totally love (ice) cream – which nearly works! Of course, TLC also means tender loving care. And, oh my!, how we’ve all needed a bit of that over these past two years. Whether that’s for each other, ourselves or our businesses, […]

When business insurance brings personal benefits

12th July 2021

As a director of a limited company, it’s pretty much a given that you’ve got your main business insurances covered – you know, the general things like professional indemnity and public liability policies. However, there are some other types of business insurance that may not be so well known but offer some personal benefits that […]

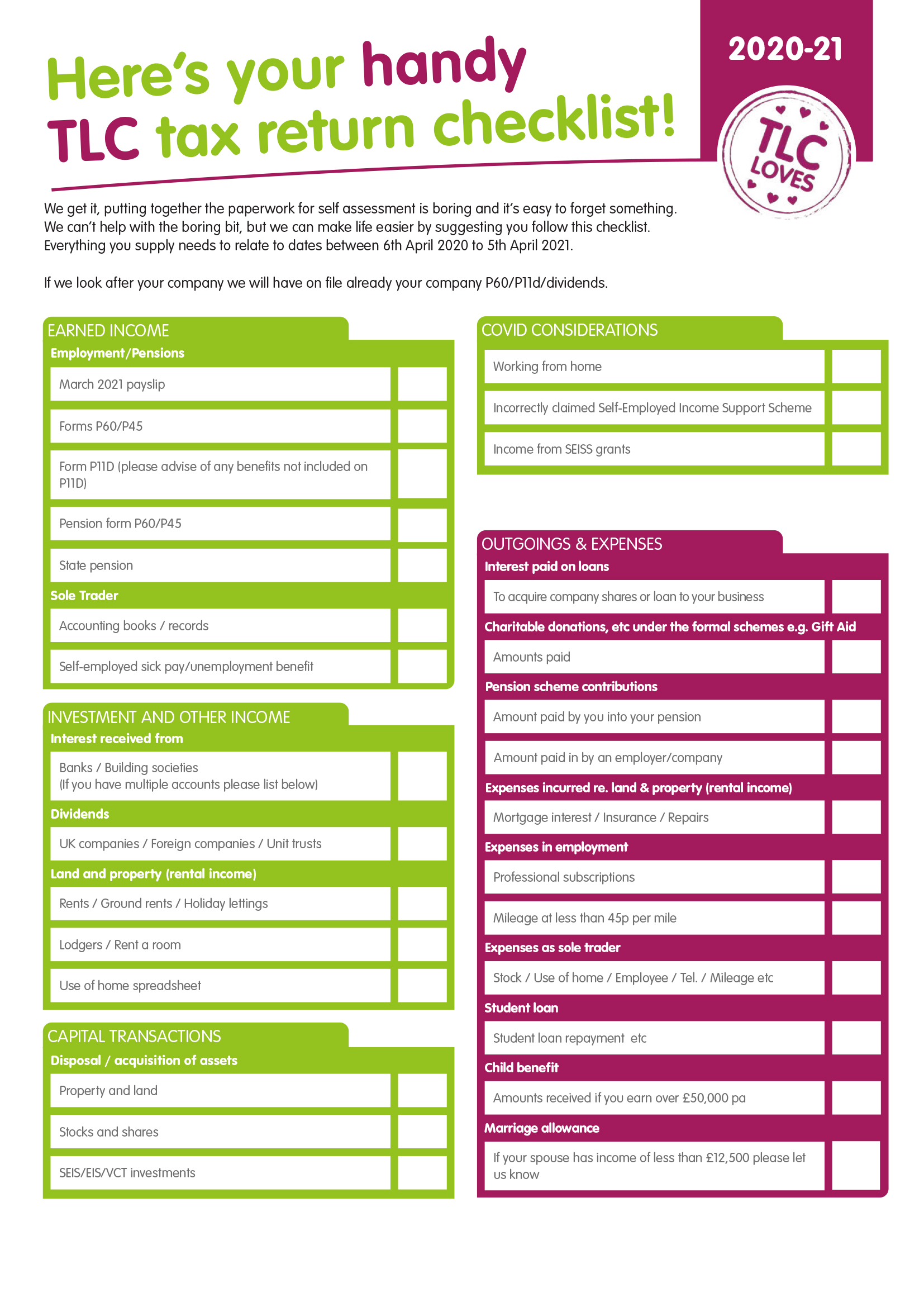

Your self-assessment checklist for 2020-21

5th May 2021

Here we are again. It only seems like five minutes since we finished filing people’s tax returns for 2019-20 and now we’re ready to start the whole process again for 2020-21! As usual, we’ve produced a handy checklist for clients to work through so they can be certain they’ve sent us all of the paperwork […]

TLC loves – looking after ourselves

18th April 2021

It’s fair to say the last 12 months have been incredibly challenging for everyone. From the Hokey-Cokey of going in and out of lockdown to the additional pressures of changing the ways we work and having children and/or other family members at home, it can feel like there’s been challenge after challenge with very little […]

Less tax, more cash: how to get ahead on personal tax

17th March 2021

With 5 April looming on the horizon, many people will now be turning their thoughts to the dreaded end-of-year tax bill. It’s a pain point for many, particularly those who fall into the ‘high net worth’ category who can often find themselves hit the hardest. Did you know, however, that with a bit of planning […]